The Hidden Secret to Scaling Success: Buy Low and Sell High with Customer Lifetime Value

If there is any law in business that would be Newtonian, fundamental, or the first building block of all knowledge, it would be this: You buy low and sell high. Empires were built on this principle. Thousands of years ago, traders and merchants made their living off it. Whether oil or fine china, wine or gold or salt, robust organizations emerged based on the principle.

Usually, we’re talking about buying goods and selling them at a higher price. However, we overlook an important application of this concept that represents a huge opportunity. It is an application that, perhaps unconsciously, many of today’s most successful companies were built on. It is an idea we talk too little about, a trick that we probably could not have named because we lacked the lexicon until the concept of customer lifetime value (CLV) was introduced.

Now, you may be familiar with CLV. You may have heard or read about it from Peter Fader, a leading authority on CLV. Indeed, it is foundational to how most entrepreneurs think, in my experience. And yet, it is still not a concept that is broadly adopted or even understood. If we understand CLV, we will realize a new way to buy low and sell high.

Understanding Customer Lifetime Value

You can value a company based off replacement cost, which in the trading business is determined by inventory. If I want to buy your company, I can simply add up all the inventory you have and pay for that inventory. But you can also value a company based off its customer base. If I want to buy your company, I can buy up all the customers. And just like you want to buy inventory low and sell it high, you want to buy customers low and sell them high.

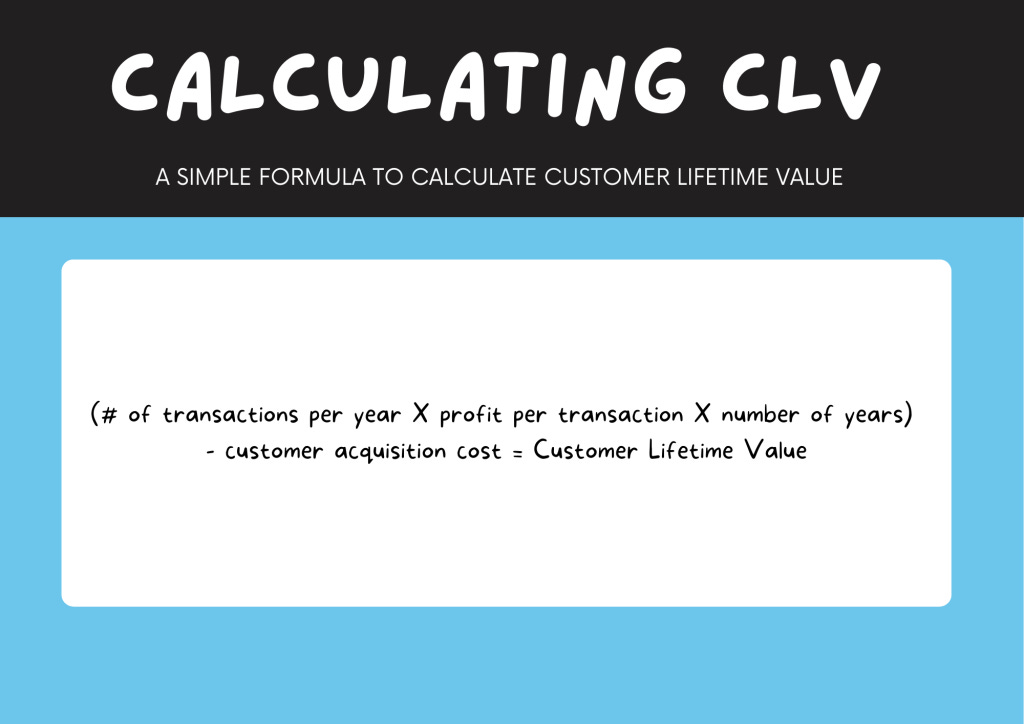

To simplify this, let’s use a formula:

(Number of transactions per year X profit per transaction X number of years) - Customer acquisition cost = CLV

This is a simplified calculation of CLV. It serves our purpose.

Acquiring Low-Value Customers and Increasing Their Value

Now, it is generally less expensive to acquire a customer of low value. There is less competition for them. This is the basis of disruptive innovation, in which a company targets a customer or market segment that its competitors view as low value. When you acquire those customers, competitors think, “Fine, take them, because they’re not valuable anyway.”

But once you acquire them, you can use those customers to learn. And from that learning, you can improve your product or service. Then with that better product or service, you become more attractive to more valuable customers.

This alone can give you a rise in value, which allows you to acquire customers that are ever more valuable. So even though they cost more to acquire, your overall value rises.

You can translate that to: How do you increase the value of a customer? By increasing the number of transactions, increasing profit per transaction, and increasing the number of years they stay loyal.

The Amazon Example

Apply this formula to Amazon, and you will see this is exactly what they did. They “bought,” or acquired, customers that were buying a certain number of books every year. The profit was not very high. In 1995 – Amazon’s first year – revenue was $511,000. But they gave customers amazing service and added loyalty to the mix. Initially, the customer might have come to just buy one or two books. But they came to love the experience that Amazon offered, and they decided to return, year after year, to buy more books. The “# of years” variable in our CLV equation increased, so the overall value of Amazon increased.

Then, in 1998, Amazon started to expand the set of products it offered. This not only increased the number of transactions in our CLV formula, but it also increased the profit per transaction because those categories are more profitable than books. Amazon’s value increased even more.

The equation grows even more powerful: more transactions X more profit per transaction X more years. And then, because you’ve already acquired customers at a low customer acquisition cost, retaining them brings your customer acquisition cost closer to zero.

Final Thoughts

When we looked at the foundations of 25 of today’s most successful businesses (Amazon, Adobe, Apple, Salesforce, etc.) we found this principle almost always applied. They didn’t only buy inputs low to sell them high, they applied the same approach to customers. They acquired customers at a low cost and increased their value over time.

The simplified CLV formula demonstrates how companies can increase the overall value of their customer base by focusing on four key factors: the number of transactions per year, profit per transaction, the number of years a customer remains loyal, and customer acquisition/retention cost.

Understanding and applying the concept of CLV is crucial for entrepreneurs and businesses looking to build sustainable, long-term success. By recognizing the potential value of seemingly low-value customers and investing in strategies to increase their lifetime value, companies can create a powerful engine for growth and profitability. As the business world continues to evolve, the ability to effectively "buy low and sell high" in terms of customer value will remain a fundamental principle for success.

Join the 4th Option Network

For coaches and other innovation practitioners, consider joining my global community of trusted strategic advisors, the 4th Option Network.